CPI Insights: September 2025 — Inflation Anxiety and the Blame Game on Social Media

CPI Insights: September 2025 — Inflation Anxiety and the Blame Game on Social Media

Analysis by RILA GLOBAL CONSULTING | 16M Consumer Conversations | Geography: USA

The September 2025 Consumer Price Index (CPI) report confirmed what many Americans already feel: the cost of living remains painfully high. But beyond the data tables and percentages, RILA GLOBAL CONSULTING’s analysis of over 16 million consumer conversations across U.S. social media platforms reveals something deeper — a public narrative shaped by frustration, blame, and political polarization.

A Public Pulse on Inflation: Anger and Blame

In September, inflation discussions dominated online economic chatter. Across millions of posts, consumers didn’t just talk about prices — they debated causes, consequences, and accountability.

Fueled by government shutdown debates, the leading theme was clear: Americans overwhelmingly blame high government spending, illegal immigration costs, and tariffs as the primary inflation drivers.

The tone was notably grim. 37% of all sentiment was negative, and only 5% was positive, highlighting an economy where optimism feels increasingly rare. The dominant emotion? Distrust. Consumers voiced skepticism not only toward policymakers but also toward institutions meant to keep inflation in check.

Healthcare Inflation: “Beyond Out of Control”

Healthcare was at the epicenter of economic frustration. Thousands of users described the medical system as “broken” and “rigged,” with widespread mentions of “insurance fraud” and excessive profits by insurance companies.

Consumers repeatedly argued that federal subsidies and mandates — particularly under the Affordable Care Act — are the root cause of medical inflation. Many claimed healthcare costs have risen faster than any other major category in the CPI, calling the issue “beyond out of control.”

These discussions reflected a broader distrust in the system: people believe federal intervention has made essential services less accessible.

Housing and Education: Structural Pressure Points

The housing conversation was equally intense. Rent, mortgages, and property taxes were described as “crippling”, with many linking unaffordability to federal housing policy and the influence of Fannie Mae and Freddie Mac.

Consumers see housing costs as the core of the cost-of-living crisis, shaping everything from savings capacity to family stability. “Even middle-income households,” many said, “are living paycheck to paycheck.”

Parallel to housing, college tuition emerged as the second most cited inflation pain point. Consumers claimed tuition prices are inflated by federal subsidies, student loan programs, and administrative bloat — all seen as examples of government actions distorting market reality.

Together, education and housing formed over one-third of all CPI-related consumer posts, signaling that these two categories dominate how Americans experience inflation in daily life.

Food Prices and Tariffs: Everyday Economics

Food inflation remains one of the most visceral topics online — a “grocery store reality check.” Americans linked soaring food prices to tariff policies, supply chain issues, and corporate markups.

Consumers expressed frustration that basic groceries — from milk and eggs to produce — have become symbols of economic inequality. Many see tariffs and trade restrictions as hidden taxes that hit everyday families hardest.

Government Spending, Policy, and the Perception of Inflation

Beyond categories, one unifying theme cut through all conversations: policy as the perceived driver of inflation.

Americans see excessive government spending, mounting debt, and subsidy structures as the core inflation catalysts. Conversations framed inflation not as a temporary macroeconomic event but as a long-term policy failure.

Mentions of “government waste,” “deficit spending,” and “economic mismanagement” rose sharply during the shutdown debates, further entrenching the belief that Washington’s fiscal behavior directly drives household hardship.

Americans Feel "Trapped"

Amid the data, the most striking takeaway is emotional: Americans feel trapped.

Consumers described how inflation is eroding their ability to afford basic needs, build financial savings, or plan for the future.

Key Takeaways from RILA’s September CPI Conversation Analysis

- 16M+ U.S. consumer posts analyzed across social media.

- 37% negative sentiment, 5% positive, reflecting deep pessimism.

- Top inflation blame factors: government spending, immigration costs, tariffs.

- Healthcare and college tuition cited as fastest-inflating categories.

- Housing and food dominate affordability discussions.

- Policy and federal intervention perceived as the root causes of inflation.

As RILA GLOBAL CONSULTING continues to monitor consumer sentiment, one truth remains constant: inflation has become as much a psychological and political issue as it is an economic one — shaping how Main Street perceives and reacts to Wall Street’s data.

Read More

What U.S. Consumers Are Really Buying Right Now: Viral Trends, High-Tech Tools, and the New Psychology of Shopping

U.S. consumers are reshaping the retail landscape in real time, blending emotional impulse with unexpected investment as they navigate economic pressure and digital influence. Social conversations show that Americans are simultaneously splurging on high-performance niche tools, making impulsive TikTok-driven micro-purchases, and buying controversial or loosely regulated products that reveal widening trust gaps in the marketplace. Even as budgets tighten, spending on beauty, wellness, and status-defining items remains resilient, signaling that identity, comfort, and social proof matter more than ever. The result is a consumer environment where viral influence outweighs traditional marketing, transparency becomes a competitive advantage, and brands must track fast-moving cultural signals to stay relevant.

November 19, 2025

READ MORE

Target in Q3 2025: What 6 Million Social Media Posts Reveal About the Brand

Target’s Q3 2025 social footprint reveals a brand caught between strong product demand and increasingly strained execution. Shoppers still love Target’s private labels, seasonal magic and exclusive collaborations, but their enthusiasm is undercut by widespread frustration with understaffed stores, long checkout lines, messy environments, unreliable digital inventory, app glitches and inconsistent delivery through Shipt and Circle 360. Social and political debates as well as safety concerns add volatility to Target’s perception, even as private-label performance and holiday readiness remain clear strengths. The data shows a widening gap between Target’s brand promise and the real shopper experience - one that represents both a risk to loyalty and an opportunity for operational reinvention.

November 18, 2025

READ MORE

Consumer Sentiment Report: October 2025 - How US Households Are Talking About Inflation, Value and the Cost of Living

The Consumer Sentiment Report: October 2025 reveals an America still reeling from the long shadow of inflation. Across millions of social posts, people voiced anger and exhaustion over prices that “went up and never came back down.” Families described feeling cornered by relentless costs in housing, groceries, healthcare, and utilities, with even higher earners living paycheck to paycheck. Consumers are adapting through extreme price sensitivity—embracing coupons, switching brands, and cutting non-essentials—while expressing deep skepticism toward policymakers and corporations alike. For brands and leaders, the message is unmistakable: the modern consumer demands transparency, fairness, and proof of value in every purchase.

November 8, 2025

READ MORE

Restaurant Loyalty in a Squeezed Economy: What 18.9 Million Online Conversations Showed Us

In a strained 2025 economy, 18.9 million online conversations reveals that restaurant loyalty now hinges on one question: is it worth it right now? Consumers praised QSR and pizza chains like Domino’s, Taco Bell, and Chick-fil-A for speed, deals, and perceived value, while fast-casual favorites such as Chipotle and Cava faced growing backlash over $18–$25 meals that no longer felt justified. This shift highlights a pragmatic consumer mindset where affordability, portion fairness, and speed outweigh novelty — signaling that the next wave of restaurant loyalty will be earned not through brand heat, but through clear value and everyday credibility.

November 4, 2025

READ MORE

PayPal (PYPL) Q3 Consumer Analysis: Trust, Security, and Shifting Expectations

PayPal’s Q3 narrative revealed a pivotal shift from optimism about convenience to deeper conversations about trust, transparency, and control. While total mentions and unique voices grew, discussions increasingly centered on account limitations, security holds, and dispute resolution—underscoring consumers’ desire for reliability over novelty. The rise in scam-related chatter highlighted growing vigilance, even as PayPal’s brand familiarity continued to inspire confidence. Meanwhile, challengers like Wise, Venmo, and Cash App gained momentum through their perceived advantages in speed, fees, and clarity. The result is a landscape where PayPal remains trusted but scrutinized—a symbol of digital payments maturing under consumer demand for accountability and seamless support.

October 30, 2025

READ MORE

Meta (META) Q3 Consumer Analysis: AI Friction and Privacy Concerns Shape the Conversation

Meta’s third-quarter consumer landscape paints a picture of rising visibility but waning enthusiasm. While online mentions grew nearly 10% from Q2, engagement and positivity declined as users voiced growing unease over AI automation, privacy, and platform transparency. The shift from giveaways and entertainment to deeper debates around governance and data handling signals a pivotal change in how audiences perceive Meta’s evolving ecosystem. Despite maintaining dominance in reach and integration, the company now faces a more critical public conversation—one defined by trust, control, and the uneasy intersection of innovation and intrusion.

October 30, 2025

READ MORE

Early Holiday Spending Sentiment in October: How Consumers Are Feeling

As the 2025 holiday season approaches, consumer conversations reveal a fascinating mix of optimism and caution. While inflation and economic pressures weigh heavily on many households, shoppers are prioritizing meaningful experiences and emotional value over discounts and mass-market products. Parents, in particular, are determined to make the holidays special for their children, even if it means turning to flexible payment options like buy now, pay later or adjusting travel plans toward affordable domestic trips. The overall sentiment suggests a redefinition of holiday joy — one centered on authenticity, connection, and creative budgeting — offering brands a clear opportunity to engage with purpose and empathy this festive season.

October 24, 2025

READ MORE

Top U.S. Consumer Concerns — Last 30 Days (RILA Global Consulting Analysis)

Over the past month, American consumers have been caught between economic pressure and cautious hope. According to RILA’s analysis of 25 million online conversations, tariffs and inflation dominate public discourse — shaping a sense of financial vulnerability that spans demographics and languages. English-speaking Americans decry tariffs as a hidden tax, while Spanish-speaking communities focus on agricultural fallout and global trade risks. Inflation’s reach now extends beyond groceries to healthcare, deepening distrust in political leadership. Meanwhile, AI-driven automation fuels job insecurity, especially among younger generations who see innovation as both opportunity and threat. Yet, amid the strain, moments of optimism — from EV purchases to financial literacy — suggest that while Americans feel squeezed, they’re still seeking control and clarity in a shifting economic landscape.

October 22, 2025

READ MORE

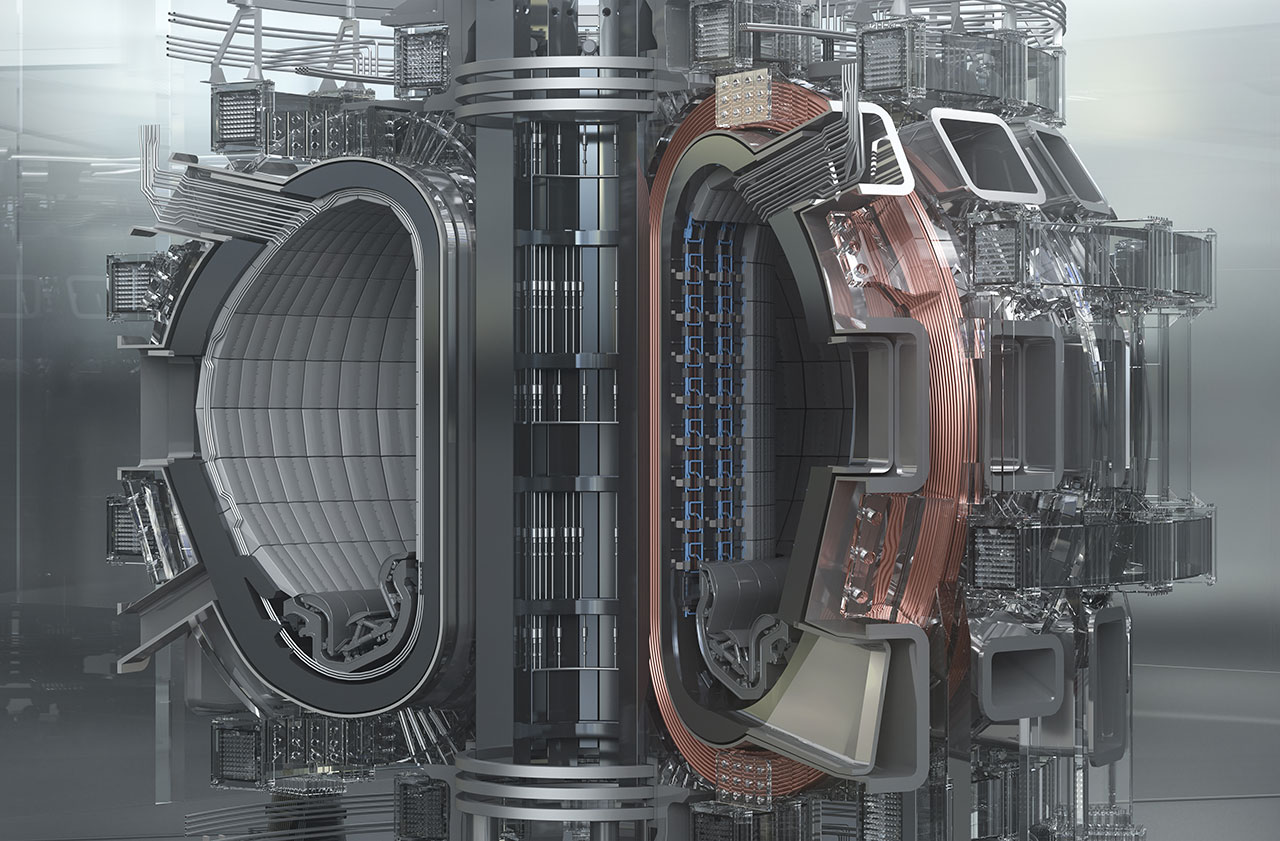

Why Social Listening is Critical for Nuclear Energy Discussions

Nuclear energy remains one of the most emotionally charged and technically complex sectors in the global energy debate, where public perception often outweighs scientific facts. This article explores how social listening has become essential for industry leaders, policymakers, and energy organizations to understand real-time public sentiment, track misinformation, and engage communities proactively. Unlike traditional research, which captures static snapshots of opinion, social listening uncovers nuanced, rapidly evolving conversations across social media and forums, allowing stakeholders to detect concerns early, address fears around safety and waste, and craft targeted, empathetic communication strategies. By integrating these insights with market research, nuclear energy organizations can foster trust, shape narratives responsibly, and position themselves strategically in the transition to net-zero emissions.

October 22, 2025

READ MORE